So you’ve decided to buy your first home? That’s exciting! You probably have a ton of questions and that’s totally normal 🙂

Most first time buyers have three top questions:

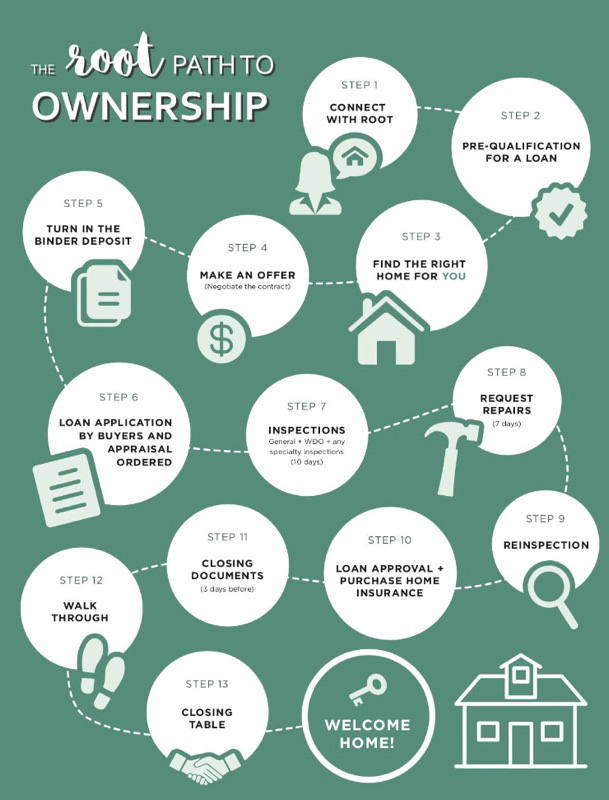

Here’s an easy step by step process to give you a general idea of how to get started…

Closing costs and down payment money can be a large chunk of money, but if you haven’t saved up enough yet, don’t worry – there are lots of strategies to help out.

Is My Credit Good Enough?

This is the other big hurdle that many first time home buyers ask and often hold them back. Then, when they finally go to speak to a lender they find out that their credit was good enough awhile ago!

Don’t wait. The best way to find this out is to talk to a loan officer. When qualifying for a mortgage, the lender looks at more than just your credit. Factors such as debt to income ratio are taken into consideration. Building a relationship with a loan officer you are comfortable with will help sort anything out. There maybe things you don’t know about that affect your ability to get a loan and a loan officer can work with you on building a plan. There may also be nothing holding you back and you aren’t aware of it.

The first step in the home buying process is working with a loan officer to get qualified. If you’d like some loan officers to talk to just let me know. Also, remember a mortgage is a product and it’s good to compare rates, terms, etc.